The Business of Access — The CEO of Arta Finance wants to make wealth a right, not a privilege

February 14, 2025

This article was originally published by The Peak on December 30, 2024. Read the original article here.

In a crowded classroom in Delhi, a young Caesar Sengupta sat among children whose lives spanned the full spectrum of privilege. Millionaires’ heirs, middle-class dreamers like him, and the son of the school’s security guard all shared the same worn wooden desks. It was a rare leveller, a melting pot where ambition and humility coexisted. The school, an Irish-Catholic institution run by Christian Brothers, was a crucible where values were forged. “Some of my best friends today are people I’ve known since kindergarten,” the CEO and co-founder of Arta Finance reflects. “But more importantly, the school’s ethics, its culture of selflessness, and the devotion of the Catholic Brothers were deeply impactful.”

Textbooks and exams formed a large and expected aspect of education here, but just as important was the quiet influence of teachers who saw potential where others might have seen just another face in the crowd. “I remember one brother in particular — when I was in Class 8 or 9, he pulled me aside and said, ‘I think you could be very good at maths.’”

That simple belief held sway, but the Brother sweetened the deal even further — one that a young Caesar could not resist. “He made me a deal: if I committed to extra maths classes, he’d let me use the school swimming pool on weekends,” he recalls with a chuckle.

But Caesar was not only shaped by school; his very name, he tells me in this conference room on the 12th floor of Arta Finance’s office at the UIC building, carried weight. In a country of over a billion people, the name is a rarity. “My grandfather, a doctor, named me. Growing up with a name like that, you either shrink away from it, or you embrace it. For me, it became something I leaned into.”

The name first became an identity, then a responsibility. “I felt like I had to live up to it. It sounds pretentious, I know,” Caesar admits, “but when you’re a kid, these things matter.”

While his childhood was defined by the egalitarian air of the school and the anchor of his name, his family played an equally significant role. His mother, in particular, bore Caesar’s potential on her shoulders. “When she had me, she thought, ‘Okay, I’m going to pour everything I can into this kid.’” A teacher by profession, she saw education not merely as a path to success but as armour against life’s uncertainties.

Still, Caesar’s intellectual awakening didn’t occur fully until college. Enrolled in Delhi College of Engineering, he initially studied electrical engineering. But then came the internet.

“Somewhere during college, I discovered computer science. Something about it just clicked.” These were the days of dial-up connections, message boards, and painfully slow downloads. Yet, for Caesar, it was magic. “I remember downloading these notes from MIT off some bulletin board system, and it just blew my mind. These were things I had only heard of, and suddenly, they were right there in front of me.”

That dial-up hum soon became the soundtrack to his nights, the flicker of his monitor a lighthouse guiding him towards something larger. It was this obsession, this clarity, that took him across the world to Stanford University.

Ceasar Sengupta and the leadership of Arta Finance with MOS Alvin Tan.

At Stanford, Caesar was immersed in a culture of unbounded ambition. “By my second year, most of what I was doing was essentially PhD-level work — hardcore research,” Caesar remembers. In those years, between the long hours in computer labs and the quiet reflection of dorm rooms, Caesar began to realise something profound: technology was as much about lines of code and sleek interfaces as it was about power — the kind of power to level playing fields, bridge gaps, and create opportunities where none existed.

The seeds of that realisation, planted in a Delhi classroom and nurtured in the digital glow of early computers, were now ready to bloom on a global stage.

Googliness

When Caesar first walked into Google’s Mountain View campus, he was stepping into a space where ambition wasn’t a dirty word — it was the baseline. The air buzzed with the hum of restless ideas, conversations about moonshots, and the promise of technology changing the world. For the techno-optimist, it felt like home.

At Google, Caesar became a key player in one of the company’s most transformative projects: ChromeOS. At a time when the world’s most widely used operating systems were expensive and resource-heavy, Caesar and his team asked a deceptively simple question: What if a computer could be cheap enough for every child in the world to own one?

“The driving motivation was the impact we’d seen from initiatives like the One Laptop Per Child project at MIT. Although it was such a powerful idea, it wasn’t scalable — it remained a research project.”

With Sundar Pichai as his boss, Caesar embarked on the journey to make ChromeOS grow beyond mere software. “Sundar and I would constantly discuss how we could take everything we knew about operating systems and figure out a way to make computers so cheap and accessible that every child could have one.”

Years later, that vision became reality. Today, Chromebooks are ubiquitous in classrooms across the globe, serving as bridges to digital literacy, creating access for millions of children worldwide. One need not look far to see these humble machines in action.

In Singapore, when the Ministry of Education launched the National Digital Literacy Programme in 2020, aiming to equip every secondary school student with a personal digital device by 2021, many schools chose Chromebooks for their affordability, ease of use, and seamless integration with educational platforms. It’s an initiative that bridged the digital divide and ensured equitable access to digital education, aligning with MOE’s EdTech Masterplan 2030.

But Caesar didn’t stop at Chromebooks. His next major project was Google Pay, an initiative that would soon revolutionise digital payments in emerging markets, particularly India. “Back in 2016–2017, India was still largely a cash economy. But when we launched Google Pay in partnership with the government, the shift was incredible.”

The adoption was, in a word, explosive. From bustling urban markets to remote villages, digital transactions became a lifeline. “Hundreds of millions of people were using Google Pay,” Caesar notes, a blend of pride and astonishment in his voice.

If anything, these projects proved that technology does not exist in isolation; they live in the messy, vibrant context of human lives. Both ChromeOS and Google Pay were proof that market share and profit margins can sit alongside access. These were tools that didn’t fit conveniently and effortlessly into lives but changed them in ways no one saw coming. “My life, in many ways, has been about figuring out how to enable equality of opportunity for people. A lot of my professional work has aligned with that idea.”

At Google, Caesar was beginning to see glimpses of his calling: “I have this ability to see technology, to understand how products are built, how they function, and how they make sense for people. And I want to use that to open more doors, to create more opportunities, to enable access for as many people as possible.”

A brush with access

After 14 years at Google, Caesar decided to leave. His departure wasn’t a retreat — rather, it was a return to something deeply personal. After years of building products that connected people to knowledge, money, and opportunity, he saw another gap: financial tools designed only for the elite. The systems that governed wealth were like exclusive clubs, their doors guarded by gatekeepers of privilege.

“I think that was part of why I started Arta. As I was rising up at Google, and at some point, we started using a private bank, I had this big realisation: Wow, this stuff is powerful. Why didn’t I know about this 10 or 15 years ago?” Caesar reflects.

His frustration was also with the outdated systems the world inhabits, perhaps a job hazard after more than a decade working at one of the world’s most technologically driven institutions. “Even when you have access, you realise it’s still very old-school. You have to talk to a banker for everything, fees are high, and the minimums are exorbitant. I kept thinking: Why? It doesn’t make sense,” he adds, slightly frustrated.

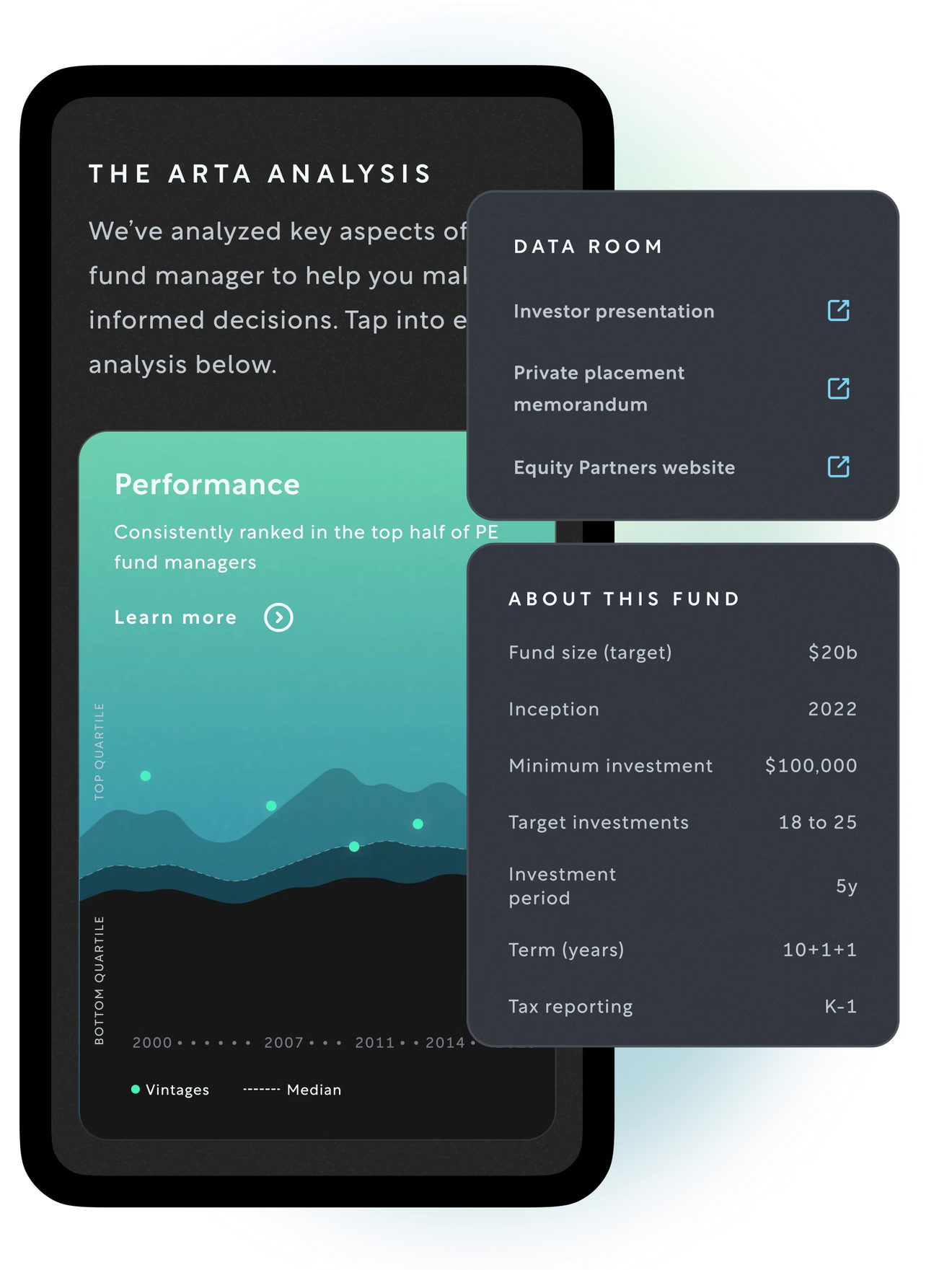

This disconnect sparked the founding vision of Arta Finance in 2022 — a platform built to democratise wealth management using AI and technology. Caesar saw the inefficiencies embedded in traditional wealth management: the reliance on manual processes, the opaque fee structures, and the exclusive nature of access.

“The only reason it’s like that is because it’s still a people-based business. People bill by the hour, and it’s not built on scalable technology. That’s where Arta Finance came from. The core idea was: We can use technology to make this so much broader.”

At its foundation, Arta Finance aims to replicate and scale the bespoke services of private banking while stripping away its prohibitive costs and barriers to entry. Caesar envisioned a platform where AI could handle the heavy lifting — analysis, recommendations, and strategy — while offering the same level of personalised financial insight that elite clients expect.

Still, he wasn’t content with simply digitising old processes — Caesar wanted to reinvent them from scratch, envisioning a system where AI algorithms learn from user behaviour, adjust to financial goals, and optimise portfolios dynamically. For Caesar, this scalability is at the heart of Arta’s mission: turning financial empowerment from a privilege into a standard expectation.

Arta’s mission then was clear: provide the tools, knowledge, and opportunities traditionally reserved for the ultra-wealthy to a broader audience. But the journey is as philosophical as it is technical.

“In the long run, what really motivates me is figuring out how to use technology to take this and get it to way more people. Today, we start with accredited investors because, from a regulatory perspective, that’s the safest place to begin. Over the next year, we’ll open up to non-accredited investors as well. We just need the right licences and smarter checks and balances.”

But Caesar’s ambitions extend beyond regulatory milestones and technological achievements. “Once we do, the technology we’ve built will allow us to open it up to everyone.” Through Arta, Caesar is challenging long-held assumptions about who deserves access to financial growth and security.

And while the platform is still in its early stages, the goal is clear: to create a world where financial empowerment isn’t a privilege — it’s a given.

Empowering financial courage

Caesar Sengupta leans back, his eyes narrowing slightly as he contemplates the future of financial empowerment. “Ten years from now, you should be able to access largely the same kind of knowledge, advice, and financial products — regardless of your income level. Of course, there’ll always be something exclusive to the ultra-wealthy, but the gap should be significantly narrower.”

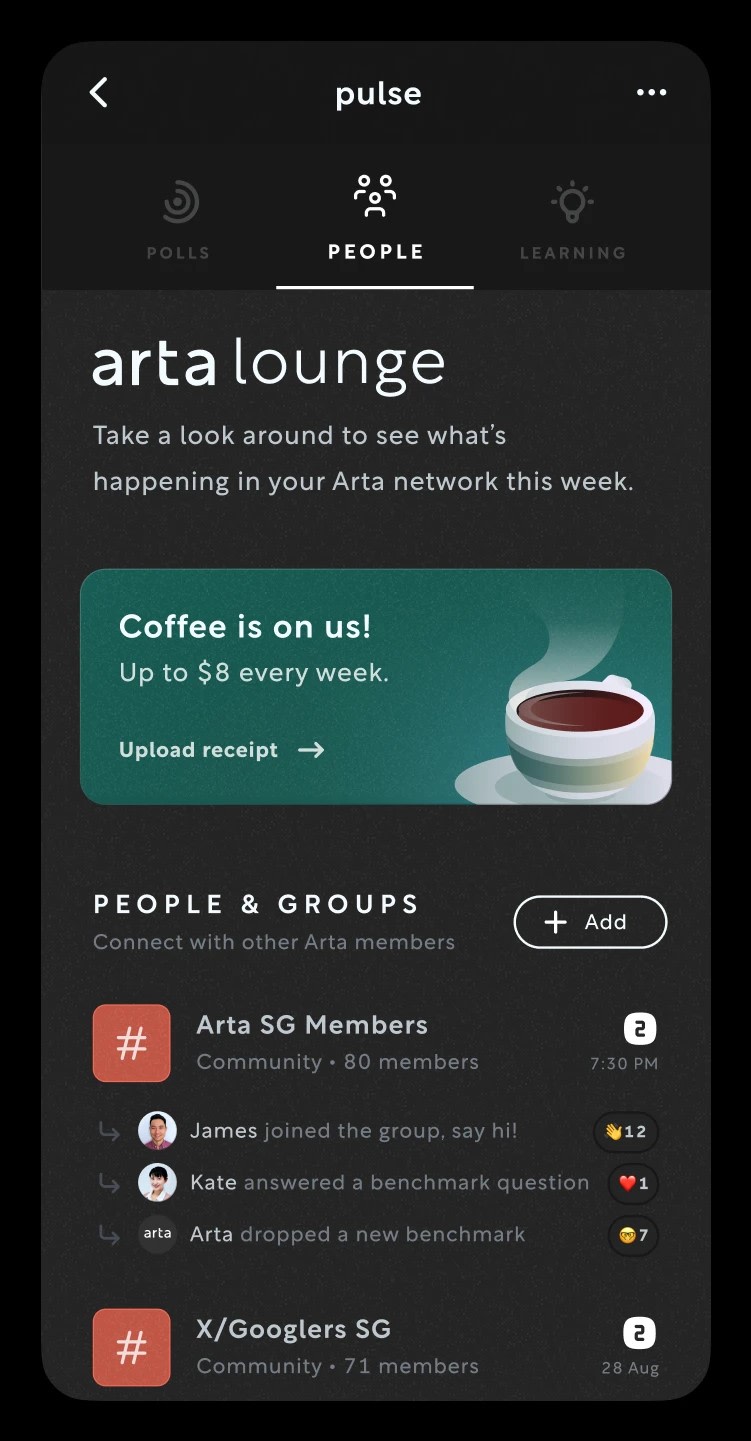

His is a bold vision anchored in specifics. Caesar speaks of a digital personal assistant — intelligent, intuitive, and deeply personal. “In the next six months or so, we think we can introduce something that feels like a financial assistant — a banker AI, as we call it — right in your pocket. This is something you can talk to, something that helps you understand your finances in a personalised way.”

But beneath the layers of technology and complex algorithms, there’s something profoundly human at its core: the fragile, emotional architecture of financial security. Financial security, Caesar understands, is often less about wealth and more about mindset — a delicate balance between confidence and fear, ambition and caution.

“When you’re building tools that democratise access to sophisticated financial systems — making sure everyone, not just the ultra-wealthy, can benefit — one of the biggest barriers isn’t just access, but financial courage.”

Wealthier individuals, he explains, often find risk-taking easier: “Financial courage ties into financial literacy, education, and understanding how to take risks. For wealthier individuals, taking financial risks often feels more natural. They’ve experienced the reward, so they’re more comfortable taking chances again.”

But what about those standing at the starting line, hesitant to take their first step? “I think you have to start people much earlier,” Caesar offers. “People need to begin in small ways, much earlier in their lives. Today, a lot of people don’t even start thinking about how to manage their wealth until they’re well into their 30s.”

It’s a generational challenge, but Caesar sees hints of change in his own household. “The youth today are actually very aware. If I compare my financial awareness at 18 to my daughter’s, who’s 17 and about to turn 18, the difference is dramatic. She’s clued in. She talks about financial concepts she sees on TikTok. Part of it is growing up in a place like Singapore, but it’s also because she’s part of the internet generation.”

But awareness, Caesar warns, isn’t enough. “If you don’t guide them early with the right kind of information, they end up putting their money in some meme coin because that’s what their social feeds are showing them. So we have to think about giving them the right tools, the right frameworks, and a better way to think about money early on.”

The greatest differentiator

Finance, Caesar observes, walks a fine line. On one side, there’s responsible, long-term planning; on the other, there’s the thrill of gambling.

“Gambling hits the dopamine side of your brain — it’s exciting, it’s quick. Long-term planning, on the other hand, requires patience, discipline, and a different mindset.” Arta Finance is betting on education, access, and technology to tip the balance. In the US, the company is already addressing a critical financial pain point: taxes. “US taxes are extremely high, and the wealthy have countless tools to optimise their tax liabilities.”

One such tool is direct indexing. “Instead of buying an ETF, like the S&P 500, our system — powered largely by machine learning — lets you buy and sell the individual components of that ETF. So, if Facebook goes down, you sell Facebook and buy another correlated stock. You still track the same overall ETF performance, but you generate tax losses.”

For years, strategies like these were playgrounds for the ultra-rich — an exclusive game with exclusive rules. But Arta is beginning to change that, offering these sophisticated tools to people with starting investments as modest as $25,000. Below that threshold, regulatory constraints still pose limitations, but even at this level, the impact is profound.

Insurance, too, has historically served as a tool of dynastic wealth transfer — a discreet yet potent financial instrument wielded by families like the Rockefellers to preserve and grow their legacies across generations. Arta is shifting that timeline. Where once these strategies were only considered by individuals in their 50s, Arta is opening the door for people in their 30s to begin engaging with them. The effect of this shift is cumulative, a snowball gathering momentum over decades.

Time, Caesar believes, is the greatest differentiator. The earlier someone begins to engage with their financial strategy, the more options, exposure, and resilience they gain. It’s not always or only about having money — it’s about having time to let that money work for you. Financial empowerment, then, isn’t a simple matter of education or access; it’s about starting early, building courage, and designing systems that guide individuals through the long arc of their financial lives.

In Caesar’s world, this isn’t a far-off dream — it’s an inevitability.

Addressing scepticism

Still, there’s one thing that someone like Caesar can count on when creating a product this revolutionary — doubt. It’s a natural response when something as deeply personal as wealth management meets the precision of technology.

After all, for generations, trust in finance has been built on relationships — firm handshakes, unbreakable eye contact, and convivial familiarity. Replacing those touchpoints with algorithms feels, to many, like a risk. It’s a question that lingers in raised eyebrows and sceptical murmurs: Can technology really handle something this nuanced?

Caesar has heard them all. “You can’t do it. It’s too difficult. Wealth management is too personal, too nuanced for technology to handle.” It’s rarely said directly to his face, but the sentiment is clear — democratising wealth feels, to some, like an impossible task.

“There’s this belief that humans will always manage money better than technology,” Caesar admits. “And in some cases, that’s true.” Yet, as he points out, technology isn’t static. AI is evolving, its capabilities sharpening at an exponential pace. What seemed unthinkable yesterday feels almost inevitable today.

Scepticism in this space often comes cloaked in a familiar argument: I’d rather have a team managing this manually for me. Caesar doesn’t flinch at this logic. “Yes, if you have the money, by all means, go ahead and have a team. I’m not trying to stop anyone from doing that.” His voice steadies. “But can we take those same capabilities — the insights, the strategies, the tools — and bring them to far more people using technology? That’s the mission.”

The surprising thing, he shares, is how many private banking clients are already embracing Arta Finance. “They realise they’re paying 1% or 1.2% in fees, and with us, they might pay 0.5% or even lower. So they think: Why wouldn’t I do it?”

Still, efficiency is only part of the story. There’s something else at play — trust. “If something doesn’t feel human, people don’t trust it,” Caesar explains. “Technology can’t be intimidating — it needs to feel empowering.” It’s a lesson he carried with him from Google. “The tech behind Google Search is mind-boggling. The scale, the speed, the complexity — it’s some of the most brilliant engineering you can imagine. But to the user, it’s just one search bar. You type something in, and it just works. It feels simple, natural, and effortless.”

That’s the gold standard for Arta Finance. Caesar envisions technology that fades into the background, that becomes invisible in its sophistication. “The vast majority of people shouldn’t have to think about how the tech works — they should just feel the experience. It should feel intuitive, seamless, and human.”

A quick demonstration

Enter ARTA AI — a product still in its early stages but already deeply reflective of this philosophy. Caesar whips out his Google Pixel 9 and starts asking Arta AI questions but not before reminding me that the app is still rough around the edges. “Hi Arta, can you tell me how my portfolio is doing?”

“Let me check on that for you,” Arta AI responds in the most natural of cadences. “Let me just pull up your portfolio performance. Your portfolio is down 0.10% today, with a return of 0.11% over the past week and 0.12%.”

“Can you tell me that just in one small sentence?” Caesar replies.

“Your portfolio is down 0.10% today with a return of 0.11% over the past week and 0.12% over the past month.”

“Can you tell me a little bit about private equity? What is it?”

“Private equity refers to investments in companies that are not publicly traded on a stock exchange, often involving a private equity firm.”

“What private equity does ARTA offer?” Caesar cuts in before Arta Ai could finish her thought.

“ARTA offers various private equity options, including the Carlyle private equity fund, among others.”

“What are the risks associated with it? What should I be watching for?”

“Let me check on that for you. The risks associated with private equity investments include illiquidity, high minimum investment requirements, and the potential for significant losses if the investment does not perform well. It’s essential to carefully evaluate the investment strategy manager and terms before investing.”

Caesar lights up as he describes the under-the-hood complexity that powers Arta AI: agentic architectures, multiple large language models, layers of data working in harmony. But then he pauses, recalibrating. “At the end of the day, to the user, it needs to feel human. The voice needs to sound human. The experience needs to be human. They need to be able to talk to it the way they’d expect to talk to an actual person.”

And that’s the heart of it — the paradox Caesar is determined to solve. Behind the Arta AI lies extraordinary sophistication, but in the user’s hand, it must feel like simplicity itself. “That’s the goal,” Caesar reminds me. “To create something profoundly complex, yet effortlessly human.”

Philanthropy and partnerships

At the launch of Arta Finance back in October, one of the things that stood out for me was their partnership with Co-Axis, a Temasek Trust initiative that aims to unlock US$30 million for global impact projects over two years. This collaboration would provide Arta’s clients access to around 100 projects aligned with the UN Sustainable Development Goals, including eight exclusive opportunities curated specifically for Arta investors.

Typically, partnerships in finance often begin with numbers, projections, and spreadsheets. But Arta Finance’s collaboration with Co-Axis started with something more personal — a shared belief in the transformative power of money when used with intention.

He references EveryChild.sg, an initiative started by his wife after leaving the government sector that was inspired by their daughter’s experiences navigating Singapore’s education system — particularly the intense pressure of the PSLE years. It’s an example of how, for Caesar and his wife, philanthropy isn’t abstract. It’s personal, rooted in lived experiences, and guided by clear goals. “You can’t create change unless you’re willing to put time, effort, money, and passion into it. While time and effort are essential, money often accelerates progress.”

The same philosophy underpins Arta’s partnership with Co-Axis. Caesar noticed that wealth and philanthropy are deeply personal — one user might care about wildlife conservation, another about funding their alma mater, while someone else might prioritise education initiatives. “There’s no value judgement about which cause matters more. But, when people reach a certain stage in life, many of them start thinking about how they can create more impact with the resources they have. That’s what we want to enable through Co-Axis.”

“But why Co-Axis specifically?” I ask.

“Trust,” Caesar says simply. “The Temasek brand carries weight. They’ve done a really good job in sourcing and conducting due diligence.”

Rather than building a philanthropic framework from scratch, Arta saw Co-Axis as a ready partner with shared goals and aligned values. “It didn’t make sense to reinvent the wheel. Instead, we saw a high level of trust, strong complementarity in terms of our interests, and alignment in goals. So we decided: Let’s just partner.”

The collaboration integrates seamlessly into the Arta ecosystem. Members can access curated Co-Axis projects directly through the app, reach out to representatives, and participate in exclusive events designed to inspire meaningful conversations about wealth and purpose. Whether through donations or cause-driven investments, the partnership represents something larger than financial transactions — it’s about aligning money with values and leaving a lasting impact.

“At Arta, our goal is to make all the things a private bank offers accessible to our members,” Caesar elaborates. It includes everything from traditional investments to philanthropic opportunities to cause-driven investments — whether it’s in green companies, education-focused businesses, or other meaningful initiatives. “This partnership is highly complementary, and it’s about giving our members a seamless way to align their wealth with their values — across investments, philanthropy, and beyond.”

Narrowing the equity gap

When asked what his ultimate objective in life would be — if success were guaranteed — Caesar leans into the question, his voice taking on a measured weight. “I think I’m actually doing it, in a way.”

For him, the greatest challenge — and the most urgent imperative — is income inequality. “One of the toughest challenges the world is going to face — if not already facing — is income inequality. And with income inequality comes a growing gap in the opportunities people have in life.”

He doesn’t shy away from the uncomfortable reality of the current world order. “I’m a big believer in capitalism, but the way capitalism, industries, and governments are structured today — especially in this era of AI — it’s creating a future where the gap between the haves and have-nots will become even more rigid, even harder to bridge.”

It’s not an abstract concern for him. He sees it in everyday moments — in the privileges his own daughter enjoys, privileges not universally shared. “My daughter, who’s 17, has had access to ChatGPT since the day it came out. But that’s not the case for everyone.”

His voice sharpens with conviction. “One of the things I’ve been advocating with our government here is: Give every kid access to AI tools — whether it’s ChatGPT, Claude, Gemini, whatever it is. Just pick one and let the government pay for it.” Without intervention, Caesar warns, the inequality will deepen. “We’ll end up with a scenario where 10% of the population — those who can afford these tools — will know how to navigate the future, and the rest will be left behind.”

He reflects on finance as one of the key battlegrounds for this fight. “Modern finance has become incredibly sophisticated, but finance and technology still haven’t truly come together in a way that makes these systems accessible and scalable for everyone.”

The imbalance, he believes, is deeply unfair. “Why should someone earning $10,000 a year have to pay more in loan interest than someone earning a million?” he questions, his voice rising slightly in frustration. “Why is it that if I deposit a million dollars into a bank, I can make that money work far harder for me than someone who deposits $1,000?”

For Caesar, addressing these inequities is personal. He does not want to get to 70 or 80, look back, and realise that he’s about to spend the next 20 or 30 years reaping the rewards of a successful life without trying to address this imbalance. “Not when I know I can see it happening all around me — I’ll feel like I failed.” He pauses, then smiles faintly. “If I can help narrow that gap — even in small ways — it’ll feel like a life well-lived.”

On legacy

As my time with Caesar draws to a close, I ask what’s one unorthodox piece of advice he can offer to someone who’s also looking to embark on the same entrepreneurial journey as him. Caesar doesn’t hesitate.

“Start meditating every day,” he says plainly.

Entrepreneurship, he explains, isn’t as much a game of strategy as it is a battle of the mind. “You’re constantly being hit from all sides — problems, decisions, fires to put out — and ultimately, it all stops with you.” In those moments, being centred, steady, and emotionally resilient isn’t merely helpful — it’s essential. “I’ve started meditating now, but I wish I’d begun earlier. I wish someone had told me: This is the one thing you cannot skip.”

The physical toll of leadership is often discussed — burnout, exhaustion, illness. But Caesar insists the mental toll is equally demanding. “It doesn’t matter what form it takes — meditation, mindfulness, prayer, or something else. You need something that helps you regain control over your thoughts, your focus, and your emotions.”

It’s a lesson more founders are beginning to share publicly. Caesar recalls a panel on mental health at the Singapore FinTech Festival, where founders at every stage of their journey opened up about their struggles. “This isn’t something that gets talked about much in finance or tech spaces, but it should be.”

And when the conversation shifts to legacy, Caesar grows reflective. “If I died today, I’d be very happy. Not to boast, but I’ve had the rare opportunity to see an entire country transition from cash to digital payments, and our team played a role in that.”

He speaks of India’s transformation, from cash-dominated transactions to QR codes on every corner. “Even the poorest street vagabonds now have QR codes,” he says with a small laugh. It’s a story he’s told before, but it never seems to lose its weight.

Legacy, though, is about people more than anything else. Caesar shares stories of his co-founders and team members, some of whom have worked with him for over a decade. “One of my co-founders has never had another manager. He joined Google straight out of college, and I was his first manager. When I left Google, he left with me, and now he’s one of my co-founders.”

Moments like these, he admits, carry more meaning than product launches or press headlines. “If I died tomorrow, I’d be happy. Not that I want to — I still want to see my kids grow up, there are places in the world I’d love to travel to, and there are many things I’d like to experience. But in terms of legacy? No regrets.”

From a modest one-bedroom apartment in Delhi to leading transformative global initiatives, Caesar’s journey is one he looks back on with gratitude.

“I’ve been incredibly fortunate. That’s the truth. And honestly, I can’t complain.”

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights